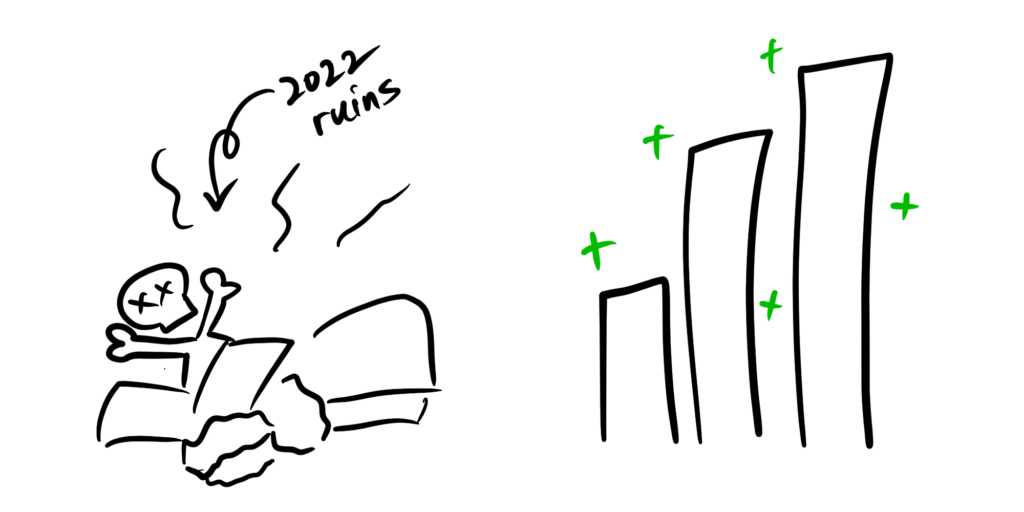

I plucked my courage and opened the Interactive Brokers App. The last I saw it, it was still in the red.

On this day, it’s red. Just less red.

Some stocks have gone up, while others stay in the ruins of the 2022 decline.

Even though most of my stocks have fallen, my portfolio isn’t dead because of the few winners. And the handful that hovers around the breakeven line.

This made me think. Customers are just like these stocks (assuming you’re a long-term investor, not buy-low-sell-high).

You spend to acquire and keep them in your portfolio, hoping the investment will pay off over time.

Your portfolio is your business.

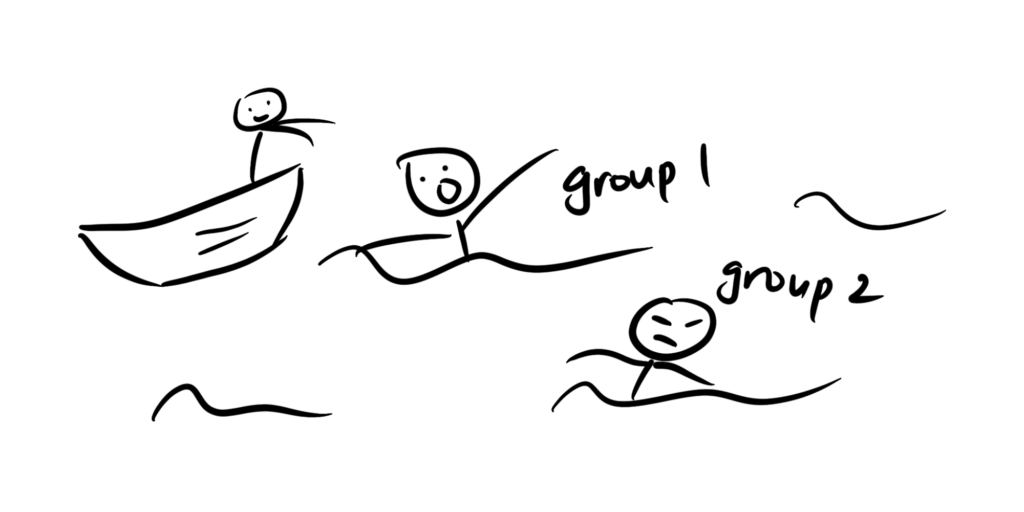

And in your business, there’ll be three groups of customers:

- Customers who spend enough to cover your CAC and operating costs.

- Customers who not only spend less than your CAC but also demand your attention and require lots of customer service.

- Customers who grab upsells, stay with you forever and even spread the positive word.

We all want group 3 customers.

But like in the stock market, you’ll never know which customers will fall into each bucket.

And after you figure that out, you can’t tell the first 2 groups to jump off the boat. Because when they swim to the shore, they’ll rush to tell other villagers.

More importantly, because you’re an ethical business.

That doesn’t mean we ignore them or give them a different treatment. Treat them well, engage with them, and provide excellent service. Some customers might eventually trend up.

But put your focus on the group 3 customers.

They’re the ones who’re going to pull your portfolio up.

How do you identify them?

In the B2C context, there are 3 ways.

1/ Use the RFM model

Recency: Someone who has bought five times a year ago would be less valuable than someone who bought twice in the past month. Because the former might have lost the need for your product or service or have found a second option.

Frequency: Yes, of course.

Monetary: But frequency has to come with monetary evidence. Basket size is most important, especially if the cost doesn’t scale.

To segment your users, it could be something like

(last order date < 3 months) + (order count > 1) + (AOV > $100)

2/ Look at the number of referrals

The ones who spawn more customers for your business help you lower your CAC.

So it makes sense to set up a referral program to encourage and reward these valuable customers. It doesn’t have to be anything fancy. In fact, the simpler the mechanics, the more successful it’ll be.

But besides the objective of encouraging more referrals, the program also helps you determine who your group 3 customers are by tracking the number of referrals.

3/ Spot your engagers

Revenue is not the only way to filter out your best customers.

Those who always share about your brand on social media. The ones who often reach out to provide reviews or constructive feedback. And those who frequently participate in your activities and campaigns.

They could be part of your group 3 as well.

Are there other ways to find your group 3s? Let me know at sushi.growth@gmail.com if you have ideas.

—

After identifying your group 3, what do you do?

I have a few ideas and have done a few others. But I’m still thinking of a good way to present them—in a separate post.